I can already hear the cries now: “Sacrilege!” from the Love-to-Organise-Everything crowd, “Click-bait!” the hopeful naysayers scream. And yet, here you are reading this in hopes that you’re not the only lost cause in a world of cute, hand-made labels with their matching, over priced storage bins.

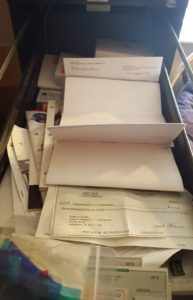

My office at the time of writing this post is a glorious mess — and more organised than usual.

My office is a testament to what happens when you have too many things going on in your business, let alone life. Here’s a common list of documents that most people have stored for reference, future inspiration, and applied work:

- Client information

- Signed contracts

- Survey responses

- Project proposals

- Blog post drafts and ideas

- Books and magazines to read

- Sales funnels

- Testimonials

This isn’t counting the to-do list hanging on the board that you’ve been ignoring for a week straight, nor the inspirational notes you have around to remind yourself you’re a badass that’s gonna succeed. And let’s not even begin to discuss all those well-meaning printables cluttering up some corner of the office.

There are ways to save and store files for your sanity, such as Natasha Vorompiova for the digital, Lifehack for the material, and Real Simple for the process. All of these methods, when used together, can make your life much, much easier for a time. I’m not saying they won’t. I’m suggesting that the life-cycle of anything is limited — even the good things like sanity from a perfectly organised life.

Because shit happens.

We all have that drawer from hell we collect things in.

We all know it does, so go ahead and admit it now. No one, not even Martha Stewart, is Miss Susie Homemaker and can keep everything perfect all the time. You know those times when your life is in chaos. The kids are needing rides everywhere, family gatherings snuck up on you — don’t forget to buy those presents, the pets need to be taken to the vet, oh, and don’t forget about that vehicle maintenance you’ve been ignoring for 6 months.

All this on top of the administrative work AND working with clients? No. You may not go back to bed and hide.

So what do you do when the SHTF?

Well, you could stop to vent your frustrations with a good workout. But, in the end, you might just have to put your game face on, roll up your sleeves, and take a day to just work through the mess.

Step 1: Dump and Sort. (OK, well, you may not want to completely dump.)

If you are anything like me, you started out with good intentions, then when life got busy, your file cabinet looked suspiciously like a teenager’s closet. Obviously, the first step is to sort that mess into something you can identify. Here are some common file types that everyone suffers with:

Automobile: Car titles, insurance policies, repair records, parts warranties, owners’ manuals, and car loan or lease documents.

Banking: Statements, cancelled checks, check registers, safe deposit box numbers and keys, and investment info.

Bills and loans: Credit card statements; receipts from utilities, cable, and phone companies; loan document; and department store accounts.

Health and healthcare: Medical records, doctor and dentist information, any and all related receipts, medical bills, health insurance policies, insurance handbooks, and insurance cards.

Housing: Mortgage statements or rent lease, house title, property appraisals, floor plans, deeds, home inspections, land surveys, title insurance policies, and property tax assessments.

Insurance: Insurance policies, policy amendments and declarations sheets.

Legal: Business registration name and EIN number, marriage certificates, birth certificates and adoption papers, estate files and wills, powers of attorney, medical powers of attorney (living wills), military service and discharge papers, passport and proofs of citizenship, and Social Security cards.

Retirement: Pension documents, Individual Retirement Accounts, Social Security information, and annuities.

Valuables: Appraisals, inventories and photographs of art, antiques, jewelry, rare books, silver, china or crystal.

Great flow chart for knowing if you should keep it by just organise your stuff. Click the image to make it bigger.

Step 2: Drink and file. I always find this job easier with a glass of scotch, but hey, that’s just me. Go for tea if you’re so inclined.

Whether you want to just file it into a cabinet until you have to suffer through this drinking session again or want to have pretty files that can be admired from afar, it’s recommended that you find some way that works for you. I suggest hitting up Pinterest or this post from Emily Lamarque to see how to use the F.A.T System in a sickeningly decorative way.

I mean, seriously, who the hell makes paperwork look so damned stylish?

The F.A.T. System is the system I prefer. It stands for File Action Toss. It works like this:

Look at the document in hand and ask yourself what you need to do with it. Is it something you need to take action on? Put it in the action section of your organisation. And then schedule a time to do it.

If it’s not something that demands action, your choice is either to file it or toss it. If you don’t need it in 6 months to a year+, toss that sucker and lighten your load. Otherwise, file it away for dealing with later. Or use the cheat sheet to the right to help you decide if that piece of paper in your hand needs to be chucked.

Once you get all that sorted, there is only one last step to attend to, and it’s the most annoying of them all.

Step 3: Get yourself a retention-toss schedule This is the part where most people snooze at, and this is why staying organised is a myth. Things change all the time.

Some documents, like your tax info, need to be held for 7 years. Other documents, like your birth certificate and identity forms, need to be held indefinitely. Warranties? While active. And, still, some documents, like receipts, you can toss once you double-check it with your bank statements. So, how do you know what’s what and when to toss it?

Be safe and check with your lawyer and/or accountant before assuming any of this is law. Things are constantly changing, and you want to make sure you’re up to date on things.

Here’s a few decent rules of thumb to follow:

- Receipts — until the warranty is up or until the end of the month if no warranty.

- Bank statements — file with your tax forms and keep them for 7 – 10 years.

- Auto records and other such policies — while the car is active, but hold onto the sales receipt with your taxes.

- Insurance policies — while active.

- Paid bills — for personal use you can toss, but if reporting with business expenses, file with taxes.

- Paycheck stubs — toss when you get your W2. If you’re a freelancer, keep it until you double-check your 1099 is correct.

- Investment records — one year or until you confirm your annual statements are correct.

- Credit card and bank statements — file with your taxes and keep for 7 – 10 years.

- Receipts and documentation for tax-deductible things — file with the taxes and keep for at least 7 – 10 years.

- Tax returns — 7 years for personal, 10 years for business.

- House related — indefinitely

- Retirement — indefinitely

- Investment statements — indefinitely.

Basically, if it can cover you in case of legal problems, keep it longer to indefinitely. If it’s not, double-check the longer standing records and toss it out of your life.

Things change constantly, keeping you on your toes. That’s why staying organised is a myth. It’s not a passive system and something that just happens. You gotta work for it.

Take our pilot class and get lifetime access for just $20 today.