You all should be used to the fact that at Insanitek we do things a bit differently with our students; teaching finance is no different. After all, this is a hands on training facility, not a school, so we have a lot of flexibility to work with personality over tests. Thus, we have a bit of fun using applied math and finance to help the students get used to the topic of money – both in terms of personal finance and business finance. Here’s our methods, feel free to integrate them into your own teaching.

Keep it open and honest.

Money makes the world go ‘round, so you might as well have it out there in the open. Not the money, but the conversation when teaching finance. We’re pretty upfront about how much things cost, our budget, and how much a fair wage is for labour. We also negotiate openly so people can realise there is value in products and services.

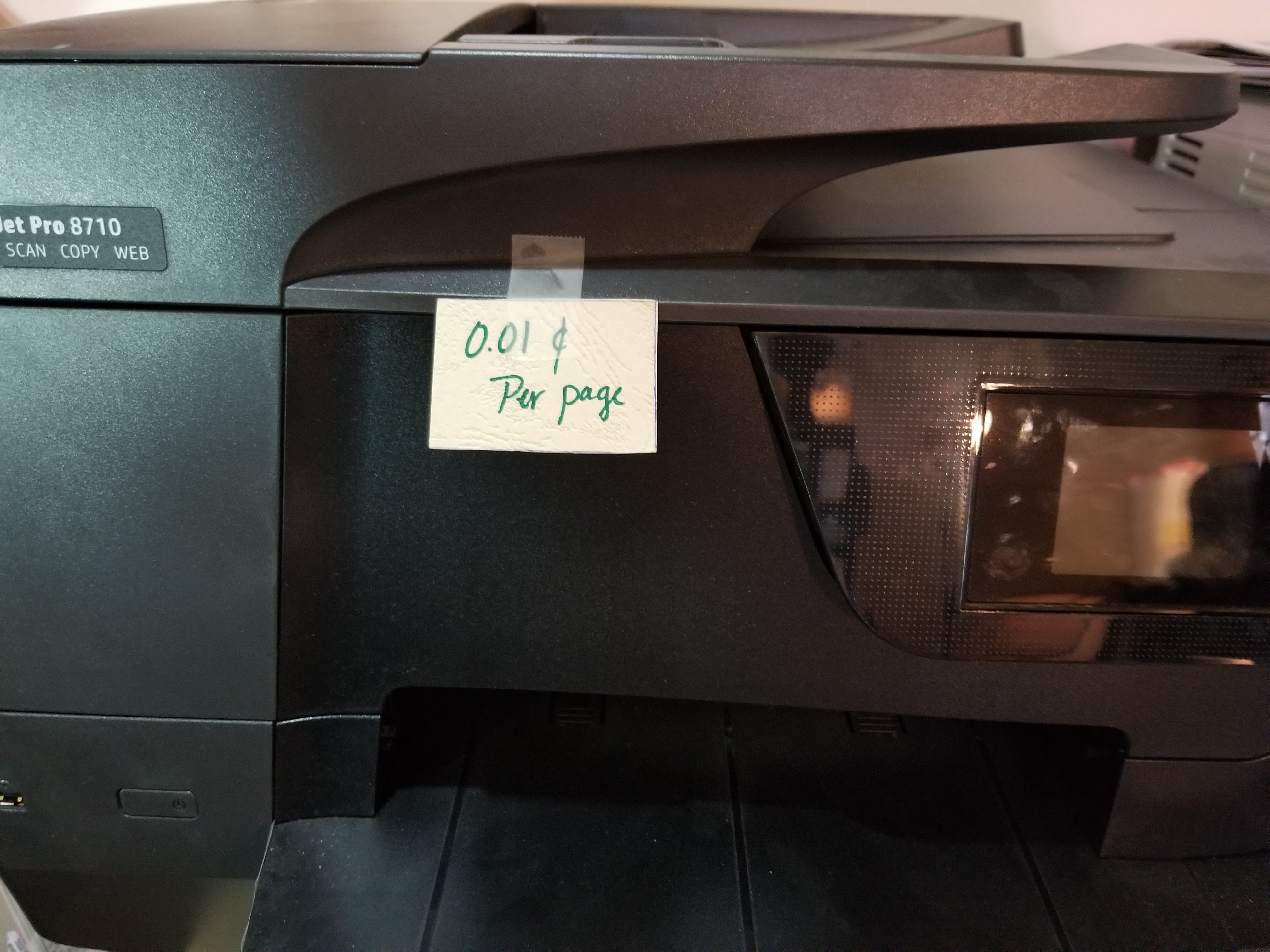

We have a value point on just about everything at Insanitek. Time on a machine, how much supplies cost, how much a particular tasks is worth, etc. We’re not joking when we say everything has a price, and we’re not shy about it. In the last few weeks, though, some of the students have started to do a breakdown of everything. For example, our printer has this simple estimate of a penny per page on it. Yesterday I was answering questions about printer supplies: where we get the paper from, how much it costs, how much the ink costs, if there is a way to lower the costs, etc. I’m sure it’s only a matter of time till the back of that tag has a breakdown of prices on it.

Earn and spend appropriately.

We’re a training facility, but so is your home. We’re both showing them how the world works, and teaching them how to make the most of any situation they are in. And, while we don’t get asked for expensive gaming systems for birthdays, we do have “favours” that people ask for. Usually this is helping out on a machine, doing tasks for one another, etc. Sometimes, though, it’s also shopping in Insanitek’s extra closet where we keep things for gifting. And that’s where the next tip comes in.

Have “chips” instead of money.

Now, we started with some poker chips that someone donated to us. Nope, I have no idea why they thought a bunch of scientists and engineers needed poker chips, but we have them, so we used them. As we just talked about above, everything, including services and tasks have a price. We often barter with one another for favours, but there are also ways for kids to earn chips for doing tasks, such as taking out the trash, sweeping, etc that they can exchange in for gift items.

There are lots of ways you can teach finance in life. These are the ones we use because they are transparent AND fun. It also leaves lots of room for bargaining, trading, and weaving in real life type of scenarios.

How do you guys weave in finance lessons to your lessons and life?