Too many people in the world don’t have a good handle on finances or they fear things more complicated than keeping a simple balance. This is detrimental to a person’s livelihood. Some people don’t live a full life, fearful that they will run out of money. Others live a life full of debt, afraid that they will not be able to have or do it all. Some don’t have money for retirement, thinking only of the day to day life while they are young.

This is not a good set of scenarios.

The good news is that you can integrate this confidence very easily into elementary math lessons.

A foundation in financial confidence starts with basic math. Instead of using apples and oranges or the infamous cart full of melons, use money units and real scenarios.

A foundation in financial confidence starts with basic math. Instead of using apples and oranges or the infamous cart full of melons, use money units and real scenarios.

This can be easily done by including your child in on planning parties and buying the supplies. After all, do they know how much goes into the annual Thanksgiving get together besides waiting hours on a turkey to finish cooking? I know I didn’t until I started participating in it.

Another way to integrate financial matters into math and life is to give them an allowance for chores done and have them buy their own toys. Not only will they understand value of their time, but also how to take care of things and have a bit of pride in their own things. I, personally, started to get these lessons when I was very young. I’ll never forget the pride I felt buying candy with money I earned putting up groceries at the age of 5.

If only things were so easy as an adult.

You can make this base balance of adding and subtracting more complicated with algebra, though.

If each piece of candy (C) is $0.05, how many pieces can I get for $3?

Notice, the first thing you can do is teach them how to read and translate the math questions from plain language. There are whole worksheets on this task alone in every grade from elementary to high school level. It’s an important skill that shows how real life can be analysed to find not just costs, but also measurable patterns.

That formula would be written in math as:

0.05C = 3

Then, you’d use basic one step equations in algebra to solve it.

This can help you budget for variety of things in life from parties requiring a truly astounding amount of watermelons to how many ice cream sundaes you could make with a single bunch of bananas and a recipe. Want more science and less life? This skill directly translates to balancing chemistry equations, figuring out physics problems, and it’s the root of some engineering (with dashes of trig, calc, and geometry thrown in).

This works with any large purchase, too. How many weeks will it take of saving allowance for the new gaming system? How many months to buy that first car? These sorts of questions can help students feel confidence with finances both now and in their future.

Bigger purchases are just longer math sentences (and some vocabulary).

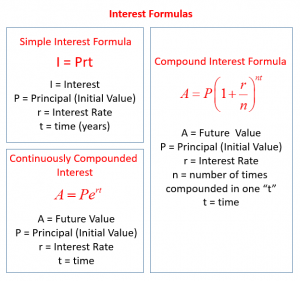

Once the confidence is built that the students understand the formula, they can save up for things like mortgages and retirement without hesitation. They know that if they save up a lot of money, the principal, then put it in a savings account, the interest they can get in return is much higher.

Once the confidence is built that the students understand the formula, they can save up for things like mortgages and retirement without hesitation. They know that if they save up a lot of money, the principal, then put it in a savings account, the interest they can get in return is much higher.

Then, the conversation can start turning into investments and risks, but also the reverse: paying off loans. When you pay a giant amount of money on say, a car, the principal they calculate the interest off of is much, much lower. Anyone can see how this is more beneficial for the buyers.

When we have worked with students with this practical approach to math, they learn both math and gain skills to live a life full of financial confidence. The formulae aren’t scary, and they even get a sense on how they can use common sense and the “rules” of the financial game to make their money work for them.

It’s always hard to talk about money. It’s hard to tell people “no” when they invite you out for dinner, yet you’re saving up for something else. It’s hard to have a deep conversation with loved ones about big financial goals ─ and stick with them over the long haul. It’s difficult to live within one’s means, especially if one desires to live within a different social status. While you work with your children through the math, it’s also useful to have conversations with them about how to have these conversations.